Author: Eduardo Montero

With more than 15 years of experience, XTB is one of the largest stock and derivatives brokers among the many options available today in this sector. Since this financial intermediary was founded in 2002, it has not stopped growing and currently has offices in more than 13 countries, including the UK, Poland, Germany, France, Spain, Latin America, the Middle East, North Africa and South Africa.

Due to its great popularity, you can find on the internet several real reviews and opinions of its clients, some excellent, some not so good, some well founded and others without any foundation.

Our goal in this article is to make it easier for you and bring you in addition to each of the features of this broker, a summary of all the opinions both good and bad, but that are well founded, leaving aside those that are simply unobjective assessments based on a particular bad experience and that often tend to be mistakes of the client himself, so you can have a clear and true vision of whether or not it is worth investing with XTB.

Main features of the XTB broker

By way of summary we can mention some of the main features of XTB:

- Easy to use, intuitive and fully customisabletrading platform (xStation) available.

- Alerts with investment ideas directly on your mobile.

- Daily investment news and videos in English.

- Chat and Customer Support 24 hours a day.

- Fast order execution speed.

- Allows you to trade CFDs on Indices, Forex, Commodities, Stocks and many more markets.

- Highly regulated broker.

- Free financial education.

Main positive and negative opinions about the broker XTB

At the beginning of this post I mentioned that there are a large number of opinions about XTB, so to save you hours of reading each of these comments on different websites, we have filtered each of the most important aspects, the most repetitive, relevant, and that in turn are well founded.

For example, many of the comments refer to the webinars and online training provided by XTB, claiming that they are a great help and guide to both novice and experienced traders in the financial markets.

On the other hand, many users comment that the broker’s own xStation platform is quite intuitive and easy to use, and that opening accounts is quite simple in the case of demo accounts, but not so for live accounts, where there are several forms to fill out and questions to answer.

Regarding regulations, its clients say that it is a serious and reliable broker, as it is regulated by the most important supervisory bodies worldwide in this regard.

In terms of commissions, XTB users say that they are quite competitive, reaching 0 for spot stocks and ETFs, and relatively low for CFDs.

On the other side of the coin, we have seen many comments from clients who are unhappy with some of XTB’s features, with many missing the ability to trade with other platforms such as Meta Trader 4 or Meta Trader 5, as well as the ability to adjust leverage for CFDs and lengthen the demo account expiry period for non-verified users.

Another negative rating from some of XTB’s clients is with regard to technical support, which according to them is sometimes unresponsive and when they do their answers are not entirely enlightening.

But it is worth mentioning that, in our case and that of other clients, we have made several queries to the support staff and most of the time we have received an accurate response and professional attention.

Also with regard to commissions, many are not too happy with the withdrawal fee, the currency conversion rates, where they are described as exaggerated.

Let’s look at all this in detail below:

Main advantages and disadvantages (based on XTB reviews).

Taking into account the collected comments and opinions we can highlight some strengths (advantages) and weaknesses (disadvantages) of XTB.

Advantages

- Trading education and training: This broker has excellent training materials for its clients, whether they are beginners or more advanced traders. Among these materials we can highlight the regular live seminars and the trading academy where we can find a large number of educational materials sectioned by basic, intermediate, expert and premium levels.

- Relatively low minimum deposit: By not having a fixed minimum deposit fee, beginner traders can experiment with the broker without having to put large sums of money in their accounts, thus, they can reduce the risk of their clients taking their first steps on the platform.

- Commission-free spot shares for clients from Europe: XTB broker allows you to trade these instruments free of commissions, you only have to pay a commission fee once you exceed 100,000 euros in volume in a month.

- Highly regulated broker: Choosing a regulated broker once we start trading is essential to keep our capital safe and the profits obtained from our performance. In this regard it is important to note that XTB is supervised by the world’s major financial authorities: FCA, KNF, CySEC, FSC and DFSA.

- Low spreads for Forex: The variable spreads applied on Forex CFDs are very low starting from 0.1 pips.

- Easy account opening: With just an email address and some personal details you can open an account with XTB. Once you have confirmed your email address, you only need to verify some personal details, such as your identity card or passport, a water or electricity bill in your name, etc…

- Variety of financial instruments: The platform allows trading in more than 5400 financial instruments in the Latin American region and more than 6100 in the case of Europe, giving investors the possibility to choose between the main assets of the market and other less known ones.

Disadvantages

- Demo account for 30 days: Users will have the possibility to use a free demo account for 30 days only, something unfavourable for users who are starting in the world of trading for the first time. However, if you are a verified XTB client, the demo account is unlimited, i.e. there is no restriction on the time of use.

- Fixed leverage: This parameter is not adjustable, we will have to operate with the leverage that comes predetermined for each financial asset.

- It does not have other platforms such as Meta Trader: Despite having an excellent trading platform (xStation), many users complain about the absence of MT4 or MT5. If this is your case, here you can find a list of brokers with MT4 and another list with brokers with MT5.

- Improvable spreads on cryptocurrencies: CFDs on cryptocurrencies apply a spread commission in percent that varies from 1.5% to 0.22% of the value of the asset in real time, which can be relatively high given the leverage of 1:2 that the broker offers for these assets.

- Withdrawals by bank transfer only: This is not a major disadvantage, but you will only be able to withdraw your capital to a bank account (that is in your name). For example, it is not possible to use PayPal or other online systems to receive your winnings. This is often a measure brokers must take to avoid money laundering in order to comply with all the regulations they are subject to.

XTB Broker Features

Let’s now take a closer look at all of XTB’s features including available markets, commissions, account types, platforms and even their regulations in order to better understand why XTB’s client reviews and ratings are so popular:

Markets

The table below shows the details of each of the markets that XTB provides, an aspect of XTB’s customer feedback that is highly valued.

| Latin America | Europe | |

| Markets that can be accessed with the XTB broker | +1500 | +5400 |

| Forex | Forex – Allows trading on 57 currency pairs. – Minimum spread of 0.1pip. – Allows micro lot trading. – Maximum leverage 1:500 | CFD on Forex – Allows trading on 57 currency pairs – Minimum spread of 0.1pip. – Allows micro lot trading. – Maximum leverage 1:30 |

| Indices | Indices – 37 indices worldwide (USA, Germany, China).- Low operating costs.- Maximum leverage 1:20 | CFD on Indices – 37 indices worldwide (USA, Germany, China).- Low operating costs.- Maximum leverage 1:20 |

| Commodities | Commodities – You can trade commodities such as Oil, Gold, Silver and 20 other assets. – Low spreads for some of the main assets such as Oil from 0.03 pips, Silver from 0.035 or Natgas from 0.01 pips. – Maximum leverage 1:20. | CFD on Commodities – You can trade commodities such as Oil, Gold, Silver and 20 other assets. – Low spreads for some of the main assets such as Oil from 0.03 pips, Silver from 0.035 or Natgas from 0.01 pips. – Maximum leverage 1:20. |

| Cryptocurrencies | Cryptocurrencies – 14 Cryptoassets including Bitcoin, Ethereum, Cardano, Dogecoin and more. – Spreads ranging from 0.22% to 1.5% of the asset value. – Maximum leverage 1:5. | CFDs on Cryptocurrencies – 14 Crypto assets including Bitcoin, Ethereum, Cardano, Dogecoin and more. – Spreads ranging from 0.22% to 1.5% of the asset value. – Maximum leverage 1:2. |

| Spot shares | Only available to European clients. | – Allows investments in Tesla, Netflix, Amazon, Banco Santander, Telefonica and many more – Over 1800 Cash Stocks from 16 of the world’s largest stock exchanges. – No commissions per trade up to €100,000 monthly volume. |

| Spot ETFs | Only available to European clients. | – Allows trading of 277 ETFs – No commissions per trade up to €100,000 monthly volume. |

| CFDs on ETFs | – Allows trading 138 CFDs on ETFs. – Maximum leverage 1:5. – Brokerage commissions 0.08 % min. 8 USD. | – Allows trading 138 CFDs on ETFs. – Maximum leverage 1:5. – Brokerage commissions 0.08 % min. 8 USD. |

| Shares | Shares – Allows trading in stocks from more than 15 countries. – Maximum leverage 1:20 | StocksCFD – Allows trading of 1901 stocks in more than 15 countries. – Maximum leverage 1:20 |

XTB Platforms

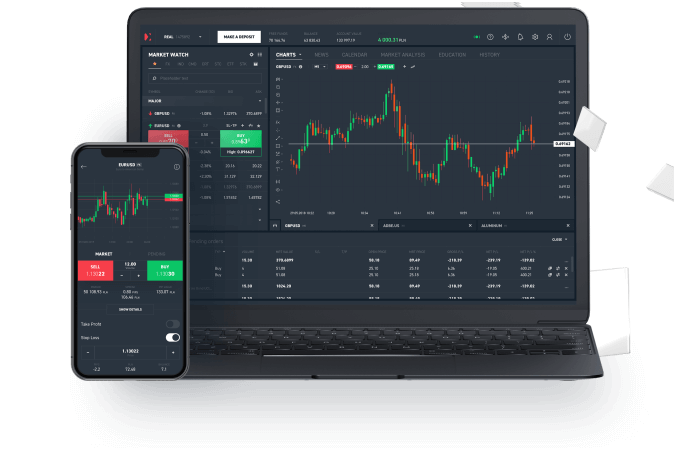

xStation 5: XTB broker uses its own xStation trading platform, where you can view the latest market news, investment ideas, a powerful set of technical indicators, trader radio, macro tools and much more – in short, everything you need to trade like a professional.

Web Terminal: Web platform that allows you to access your trading account without having to download and install any software on your device. This web terminal offers access to advanced tools for more experienced traders. It is also fully compatible with Chrome, Firefox, Safari and Opera browsers. This terminal is the web version of its xStation platform, so you will have all the functionalities available on it.

xStation Mobile (App): This is the mobile version of its platform. Through the XTB app you will be able to enjoy all the functionalities you need to invest and manage your investments easily. It is important to note that this application is available for both iOS and Android systems.

Analysis and training tools

In this section it is worth noting that XTB cares about the training of its customers, as it has a fairly extensive training program in which we can find video tutorials, articles, and even a trading academy, with courses ranging from the most basic aspects, to the most advanced. They also provide live seminars, which are given by experts every day at the opening of the market.

It also has an economic calendar where we can find the most important events related to the world of financial investments.

This calendar, together with the daily news provided by the broker and the price table of all the assets on the platform in real time, allows users to be informed at all times and ready to enter the market.

XTB’s main commissions

As far as commissions are concerned, we can classify them as operating commissions and non-operating commissions.

Operational commissions are, for example, those that the broker charges us in the form of spreads, trading volume and even nightly fees, while non-operational commissions refer to the commissions that we must pay for example when depositing or withdrawing funds from the account, using a certain tool (such as a VPS), currency exchange, etc…

Please note that the fees shown are indicative and correspond to the time of writing this article. To find out XTB’s current commissions you should visit their trading platform or visit their website: https://www.xtb.com/

Trading commissions

XTB does not charge any commissions on the Standard account (except for Equity CFDs and ETFs). However, clients will have to pay a slightly higher spread than on the Pro account.

The spread is variable and will depend on the market situation at the time of trading.

On the Pro account, which as mentioned above is not available to new clients, XTB charges a commission on each trade, but the client trades with market spreads, i.e. the best spreads available.

It is important to note that XTB allows spot stocks to be traded commission free, we will only have to take a commission payment, once we exceed 100 000 euros of volume in a month. It should be noted that spot shares are only available in Europe.

As for the overnight fees, it is important to note that they will be applied if you leave one or more trades open overnight, as a result of trading with leverage (money borrowed from the broker).

In this regard you should note that these fees are charged daily as long as you continue to have open positions, and are calculated based on a percentage of the total amount invested for each operation.

Non-operating fees

In this point, the most relevant to highlight are the commissions charged by the broker if we make a withdrawal of less than 200 euros, in which case we will have to pay 20 euros. At this point it is worth clarifying that this commission only applies to European client accounts.

Another non-operating fee that the broker may charge us is linked to the inactivity of an account for more than 12 months, in which case we will have to pay 10 euros or its equivalent in another currency, on a monthly basis until we start trading again or we unsubscribe from the platform.

This fee is only charged on European accounts as the inactivity fee is not charged in Latin America.

Another commission that could affect you at XTB is the currency exchange fee, as you can only have an account in US Dollars (USD), Euros (EUR) or British Pounds (GBP) and it is applied when you trade products that involve a currency other than those three. It is usually 0.5% of the total.

You can find out more about XTB’s fees in this article: XTB Fees and Commissions.

Is XTB a safe broker?

XTB was founded in 2002 in Poland as X-Trader Broker, which later became XTB. As you would expect, this broker has some of the world’s most important regulations in the financial services sector, which is quite logical given the broker’s track record and reputation with its clients.

Regulations

Among the entities that regulate it and that are listed on its website we can mention:

- The Financial Conduct Authority (FCA) of the United Kingdom.

- The Cyprus Securities and Exchange Commission (CySEC).

- The Polish Financial Supervisory Authority (KNF).

- The Comisión Nacional del Mercado de Valores (CNMV) in Spain.

- The International Financial Services Commission (IFSC) of Belize.

- The Federal Financial Supervisory Authority (BAFIN) of Germany.

Security of Funds

XTB attaches particular importance to the protection of its Clients’ Assets deposited in accounts held by XTB. Client funds will only be deposited with reputable banks.

XTB assesses each year the creditworthiness of the institutions where client funds are deposited and, on this basis, decides whether to continue or cease cooperation with each institution.

It also keeps the funds distributed among various banking institutions to ensure the safety of the deposited assets.

It is worth mentioning that XTB is included in the clearing scheme managed by the Polish National Depository For Securities in order to guarantee cash payments to clients up to the legally established level, and the compensation of the accumulated value of financial instruments lost by the client in the following cases:

- XTB’s insolvency proceedings are declared, or

- An application for insolvency proceedings be dismissed on the grounds that XTB’s assets are not sufficient to cover the costs of the proceedings.

- That the Polish Financial Supervisory Authorities understand that, due to reasons directly related to the financial situation, XTB is, and will remain for the foreseeable future, unable to meet its obligations to Clients.

The compensation scheme maintained by the Polish National Depository For Securities ensures payment of client funds and compensation of the value of lost financial instruments that would have been accrued by these clients, less the amounts owed by the Client for services received.

The payment shall comprise 100% of the funds covered by the compensation scheme up to a limit of EUR 3,000, and 90% of the remaining funds up to a maximum limit of EUR 22,000.

Taking into account all the regulations to which XTB is subject and the value it places on the security of its clients’ funds, the comments, ratings and opinions we have found in various online media consider it to be a fairly safe and reliable broker.

What user profile is XTB suitable for?

Taking into account the characteristics of XTB, and the opinions of its clients, we believe that this broker is suitable for any user profile, but it is a little more suitable for more advanced users, as some of its products can be a little more confusing or risky for beginners, such as derivatives, especially if it is not possible to operate without leverage or even adjust it.

Another factor that makes us conclude that it is better suited to experienced investors is its xStation platform, as even though this is an excellent platform with all the necessary tools for any type of trading or analysis, it is still somewhat complex to use.

However, as we mentioned earlier, we can also recommend this broker to beginners because of the fact that XTB is a very complete broker with a lot of information and courses available for beginners.

How to open an account with XTB?

Just a few years ago opening an account required a visit to the investment firm’s offices, or sending an online application and signing a paper version of the contract (sent via courier).

Nowadays, the opening procedure is much simpler because some investment firms, such as XTB, allow the creation of an account online without unnecessary formalities, and the whole process, from registration to receiving the access data to your trading account takes no more than fifteen minutes.

Types of accounts available

Currently XTB only offers its clients a Standard account and a Demo account.

The table below shows the details for each type of client. On the one hand we show the European clients and on the other hand those from Latin America taking into account that there is a subsidiary in charge of each of these areas of the world.

| Latin America | Europe | |

| Standard Account | Yes | Yes |

| Execution Type | Market | Instant / Market |

| Types of instruments | Forex, Commodities, Indices, Cryptocurrencies, Stocks, ETFs. | Forex, Commodities, Indices, Cryptocurrencies, Stocks, ETFs, Cash Equities |

| Minimum Deposit | from 0 USD | from 0 USD |

| Maximum Leverage | 1:500 | 1:30 |

| Minimum spread in pips | 0.7 pips | 0.08 pips on EUR/USD |

| Trading platform | xStation in its web, PC, smartphone and smartwatch versions. | xStation in its web versions, for PC, smartphones and smartwatch. |

| Commissions | No trading commissions on Forex, Indices, Commodities, Equity CFDs, ETFs and Cryptocurrencies. | Commission from 0.08% per lot for CFDs on Stocks and ETFs |

| Minimum trade size | 0.01 Lot | 0.01 Lot |

| Automated Trading | Allowed | Allowed |

| Account Maintenance | Free | Free for the first year. After this period a commission of 10 Euro per month will be charged as long as the account is inactive. |

Opening an account with XTB

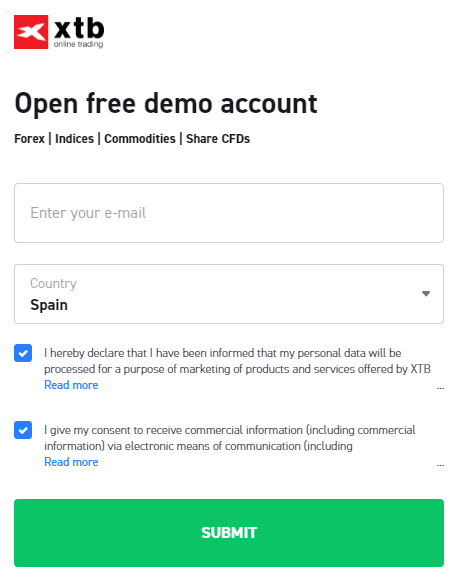

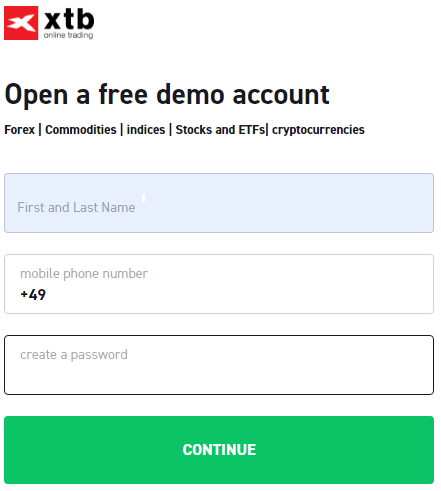

Opening a verified XTB account is a complex process, but to open a demo account you only need to follow three simple steps:

- Access the broker’s official website: https://www.xtb.com/

- Fill in an online form with an email address you have access to, your country of residence, and then agree to be contacted by XTB.

- Then enter your name and telephone number, as well as a secure password.

- And that’s it, if everything has gone well you will be able to access the investment platform, where you will find the quotes and trading panel.

Summary of XTB Reviews and Opinions

As a summary we can say that like any other broker, XTB has its good and not so good things, but its more than 18 years of experience gives it a clear advantage over many similar brokers, which have not yet matured fully.

Main advantages according to user reviews:

- A fairly intuitive and easy-to-use proprietary platform

- A large number of available market types and instruments

- High-quality analysis and training tools in English

- Easy and fast account opening

- Competitive spreads and 0 commissions for spot stocks and ETFs

It is not difficult to think that XTB can be a good choice for any type of investor especially for traders with some experience.

Bearing in mind that there is still room for improvement (which beginners would appreciate) such as, for example, that:

Points to improve according to the experience of its clients:

- Demo account is not limited to 30 days only, so that beginners can have more practice time before deciding whether to verify their account with XTB

- The platform being intuitive, it still needs a bit of finishing touches to make it much easier to use. We can find for example reviews of other brokers with more intuitive platforms or with more tools, such as reviews of Pepperstone which offers third-party platforms such as MetaTrader or cTrader or reviews of IC Markets, a broker with similar characteristics to Pepperstone.

- You can choose from a range, which leverage best suits your level of risk.

And so far, this detailed analysis about the features and opinions about the XTB broker. If after reading all this information you have any questions, you can write to us in the comments, so that we can help you

If you want to try the services of this broker, without putting your money at risk, you can open a free demo account with XTB and draw your own conclusions.

On the other hand, if we have been able to help you make a decision, it would be great if you could share it on social networks with your friends, who can also access this content.

See you below in the comments.

This post is also available in Spanish: opiniones xtb