Author: Eduardo Montero

Almost any broker’s profits come from commissions. It is the same for financial intermediaries, each of their clients must use the services of a broker to open and close trades on the stock market, so no trader escapes the commissions and fees they have to pay for their trading.

If you are thinking of trading online with XM broker, you are in luck because in this post we will detail each of the fees and commissions that you will have to face if you use the services of this broker.

But first you should know a little more about XM, because even though its costs are quite competitive, it is important to have an idea of the services and features it provides to help you make a better decision.

Main features of the XM broker

XM is just a trading name owned by a financial services company, Trading Point Holdings Ltd. Founded in 2009 and headquartered in Cyprus, this broker has a presence in more than 190 countries, and offers the possibility to trade a wide range of financial products, such as Forex currency pairs, precious metals, energy, futures, indices, and others.

With XM broker you can open more than one account and deposit a minimum of $5, and you can trade by connecting your account to industry-leading platforms such as MetaTrader 4 and MetaTrader 5.

You will have the possibility to open a demo account with XM with $10,000 virtual balance for free and unlimited time, so you can test strategies or see how the commissions of this broker could affect you, even before risking money out of your pocket on a real account. Just know that if you don’t show any activity for 90 days or more, this demo account will be closed, with the possibility to re-create another one as long as you don’t have more than 5 active demo accounts.

In terms of security we can say that it has several of the most important regulations worldwide among which are those of CySEC, FSC and ASIC.

If you want to know in depth what are the opinions of its customers you can take a look at this article: XM broker customer reviews

Summary of XM’s main commissions

Let’s first take a look at a summary of the fees that you will have to pay if you use the services of this broker and then look at each of the details.

The fees and commissions you will face at XM are:

- Spreads or spreads when trading any of your markets.

- Fixed commissions on Zero accounts when trading Forex.

- Swaps generated by holding one or more trades overnight (from before 17:00 New York time until after 17:00 New York time).

- Inactivity fee if you show no account activity for more than 90 days.

- VPS service usage fee, if you do not meet the requirements for it to be free of charge. Please note that this service is optional, only for those interested in automated trading.

- Commission for withdrawals under $200 by international bank transfers.

On the other hand, you will not have to pay anything for:

- Open one or more trading accounts

- Access the free demo account, which is unlimited in time of use

- Use the platform tools offered by this broker

- Access the educational materials available on their website

- Make deposits and withdrawals via electronic payment gateways, and Visa/MasterCard deposits

- Receive professional trading signals twice daily

Before addressing each of XM’s fees, it is important to know that there are two categories that encompass any kind of commission:

- Operating Commissions

- Non-Operating Commissions

An operating commission is one that we are charged by the broker every time we open, close or maintain a trading position, which can be a fixed fraction, a percentage, or the difference between the bid and ask price (spread) of an asset.

A non-operating commission, on the other hand, is a commission that you must pay to the broker for extra operational reasons, for example, for deposits and withdrawals, account maintenance or even to use one of the broker’s tools or services.

Knowing this, we can start detailing each of XM’s fees and commissions, starting with the ‘Operational’ ones.

XM Broker Spreads and Commissions

Spreads

As mentioned above, spreads are the product of the price difference that the broker receives from its liquidity provider. Such a spread is known by subtracting the bid price (ASK) and the ask price (BID) offered by the XM broker.

This means that when you want to make a buy position you will be given the highest price (ASK), while if you want to sell, it will have to be at the lowest available price (BID).

With XM the spreads are variable, so in most cases they will be much lower than if you were to trade on a fixed spread model, as with this model you will have to pay an insurance fee, also, when brokers offer fixed spreads, they usually apply trading restrictions during important news announcements, so the insurance loses all its value.

That is why XM does not impose any restrictions on major news releases and does not apply restrictions on the trading strategies you want to use.

Another thing in XM’s favour when it comes to spreads is that it offers fractional point pricing, allowing you to get the best prices from your liquidity providers, which means that every client can benefit from smaller price movements, having a fifth digit (fraction) available for trading, which translates into more accurate quotes and tighter spreads.

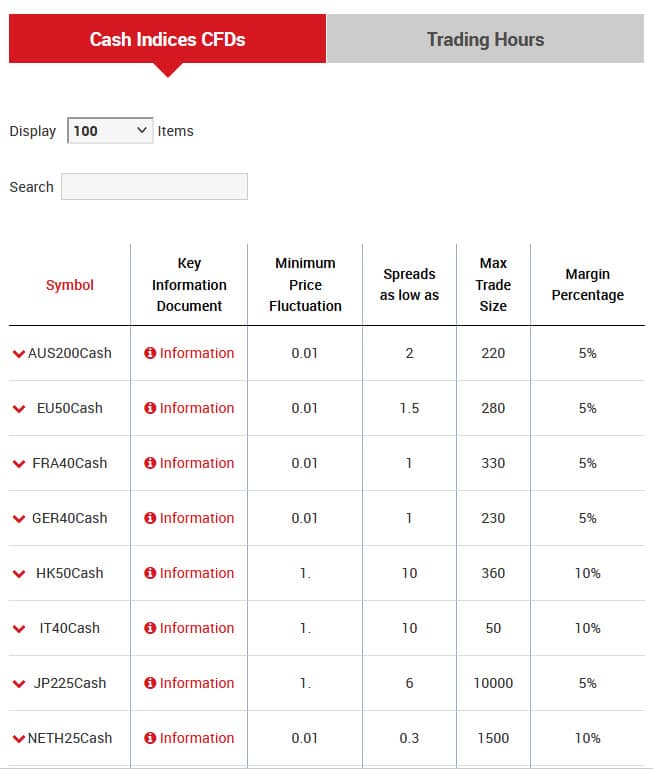

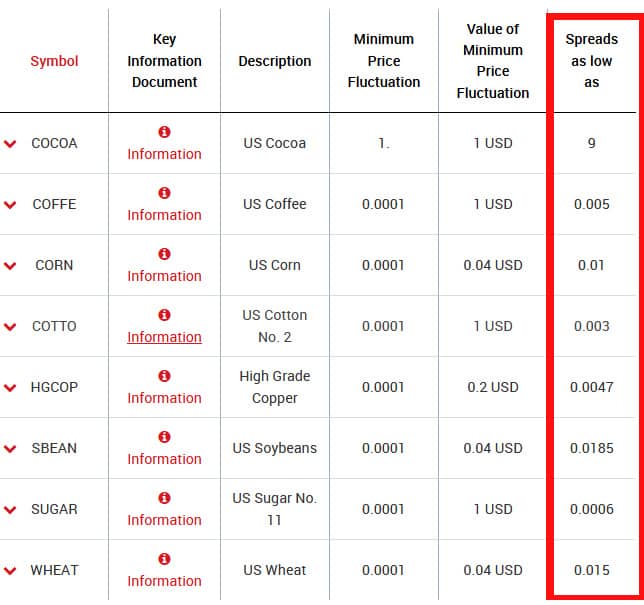

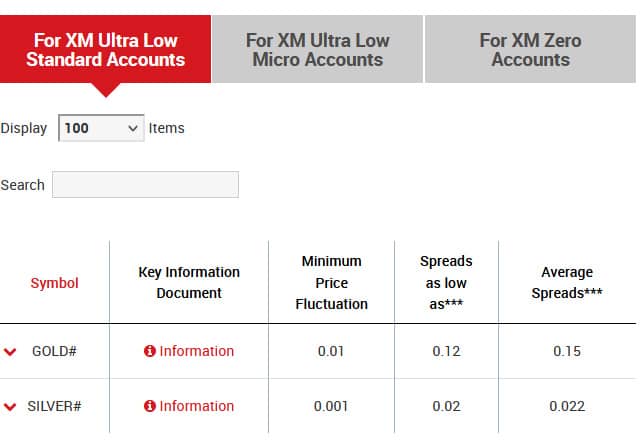

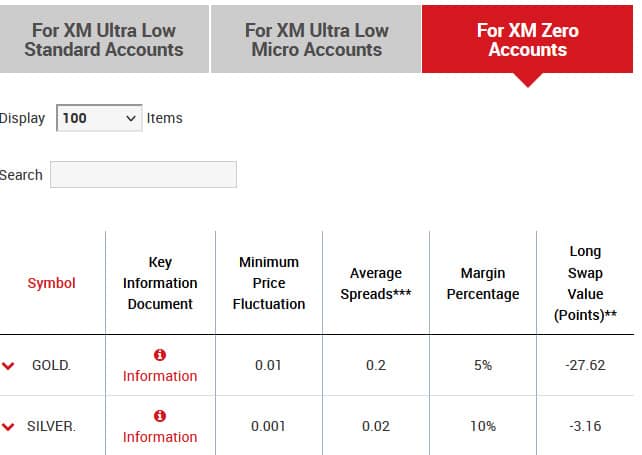

Below are some examples of spreads associated with XM’s most common assets across the various market types it offers.

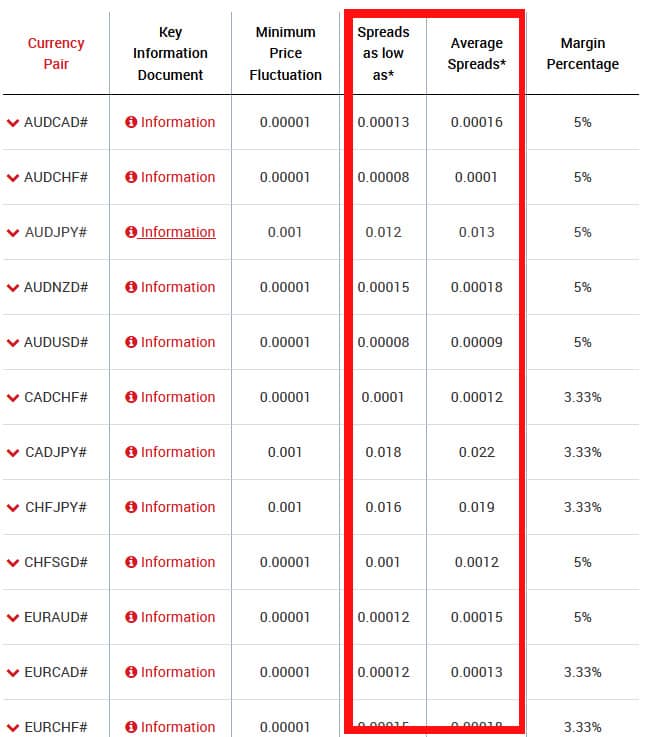

Forex

Standard Account:

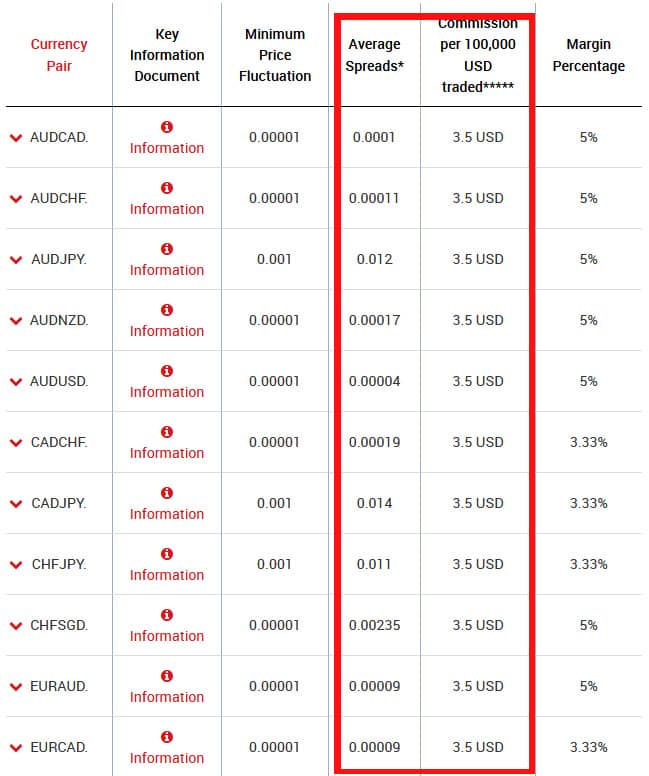

Zero Account:

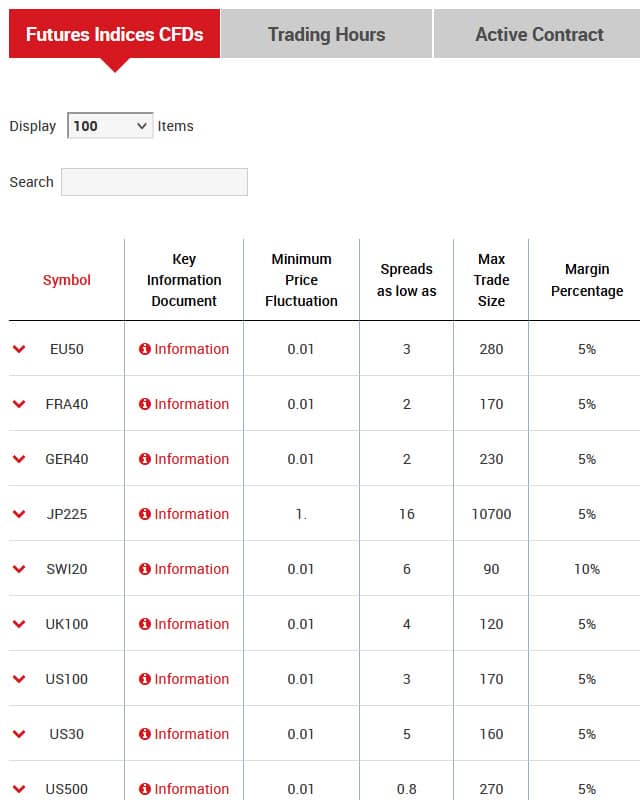

Indexes

Commodities

Metals

Standard Account

Zero Account

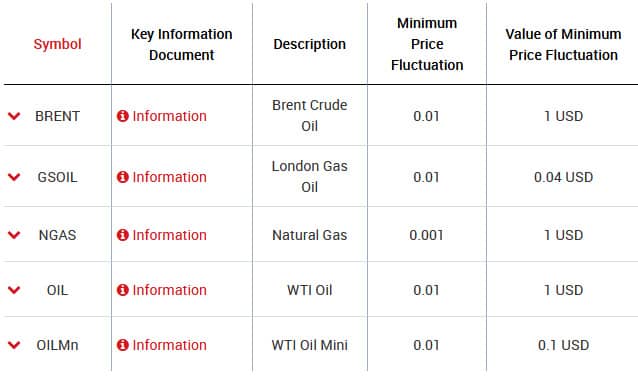

Energies

Fixed Commissions

XM offers three types of accounts, one of which, in addition to the spread, has an associated fixed commission on Forex market assets.

We are referring to the XM Zero account, which offers significantly lower spreads than the other two accounts, but in compensation applies a fixed commission per traded lot (100,000 units of the base currency).

This commission will be 3.5 USD per side on each lot traded (100,000 units of the base currency), for example:

If you open a 3 lot buy trade, it means that the volume of the transaction is 300,000 USD, therefore it would be $3.5 USD per side (open and close), per lot, i.e. (3.5 x 2) x 3 = $21. Therefore the commission you will have to pay for opening a 3 lot position will be $21 USD.

Swap commission on XM

The swap commission is another of the fees belonging to the group of operational commissions, as they are closely related to some operations.

Swap fees are generated as a result of holding one or more open positions from one day to the next, where the end of the day coincides with 23:00 hours in Spain and 17:00 hours in New York.

The process of holding a position overnight is called Rollover, which means extending the settlement date (date when the order is to be settled) of an open position.

In spot trading a trade is allowed to be liquidated up to two days later, which means in this case delivery of the asset, however, when trading with leverage there is no delivery of assets so all open positions must be closed at the end of the day (22:00 GMT), and reopened on the next trading day.

The rollover is agreed with a swap contract, which can deduct a cost or a profit for traders, depending on the prevailing interest rate for the asset involved.

Another thing to note is that there is no rollover on Saturdays and Sundays, but the banks still calculate interest on open positions on these days, so to even this out XM applies a 3 day rollover charge on Wednesdays, and this specific day is charged for the banks’ settlement time which is set at two days.

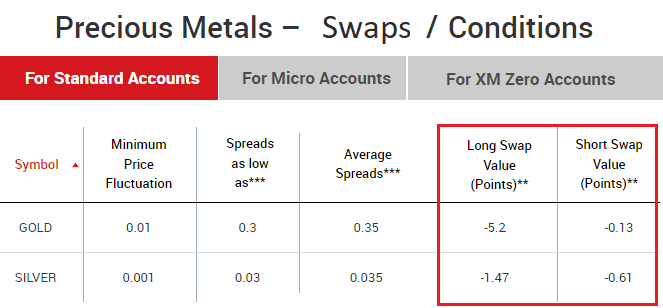

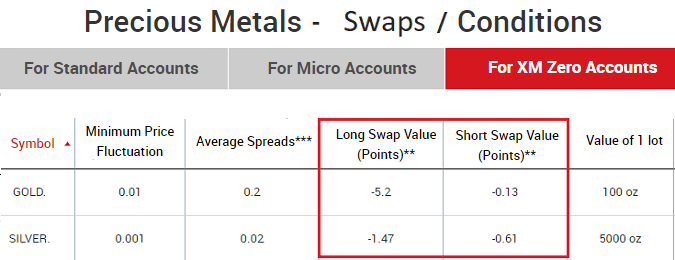

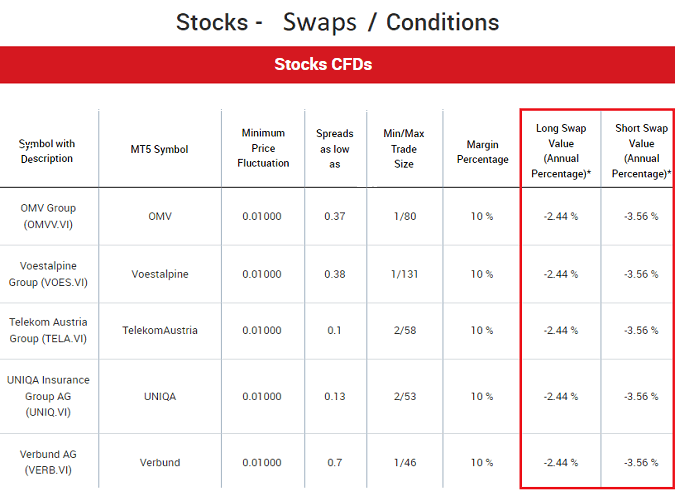

Below are some examples of XM’s swap rates on some of its assets:

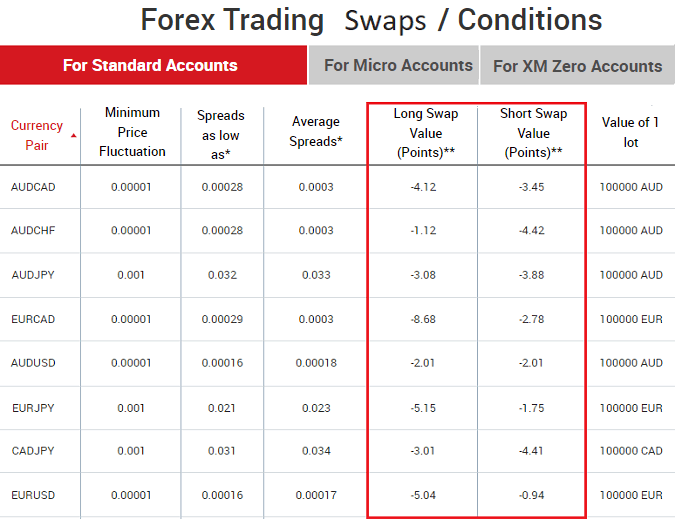

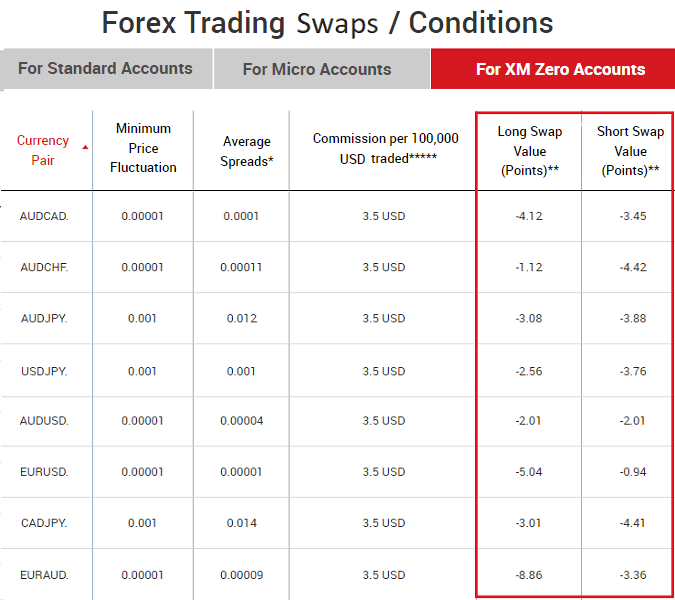

Forex Swaps

Standard Account

Zero Account

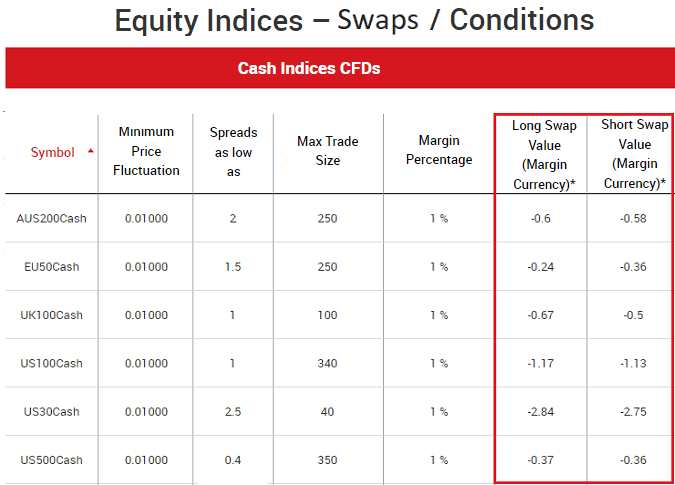

Index Swaps

Swap on Metals

Equity Swaps

To find out the rollover fee for specific assets you will need to look them up by accessing the information for each one from the trading platform you are using with XM, either MetaTrader 4 or MetaTrader 5.

Another important thing to know is that XM offers its Muslim clients Islamic (swap-free) accounts, which are free of overnight fees.

You will also not have to pay swap commissions if you trade Futures contracts.

Exchange rate commission

The foreign exchange fee is another fee that you will face at XM, as with almost any other broker, which is considered a non-operating fee, as it can be present even when you are not trading, for example, on deposits and withdrawals.

XM does not charge additional currency exchange fees, as it takes the value of the exchange rate directly from the interbank foreign exchange market.

Inactivity fee

Inactivity fees are commonly charged by some financial intermediaries. In the case of XM, it states that a trader is considered inactive if in the last 90 calendar days there has been no trading activity, deposits or withdrawals, internal transfers, or additional account registration, a rather long period compared to other brokers who set it at 30 days.

In such a case XM will proceed to remove all remaining bonuses, promotional credits and XMP. In addition it will deduct 5 USD per month or the total amount of available balance in such accounts if it is less than $5, if there is no equity in the account the charges will not be levied (which would be a negative balance if they were to be levied).

Fees for deposits and withdrawals

XM is quite transparent with their commissions, so they make it clear that they do not charge any additional fees for withdrawals or deposits, on the contrary, they will take care of the fees generated by the payment processors on each transaction, so if you deposit $100 USD, you will receive the same amount in your trading account, and the same for withdrawals.

However, it should be noted that this only applies to online wallets, and deposits by credit or debit card, or international bank transfers of more than 200 USD, otherwise the operational costs will be passed on to the client.

Please note that in some cases there may be non-XM fees applied by your bank, for example for receiving money, financial intermediaries or the payment method you use.

Other XM fees

With XM, you will not have to pay any extra fees or commissions beyond those mentioned throughout this article. Therefore, opening an account, accessing the demo account, or using their platforms and tools, are free of additional costs

There is only one (optional) service that may have an additional cost if certain operational requirements are not met, the VPS (Virtual Private Server).

The VPS is a tool that, if you are interested in algorithmic trading, allows you to install your expert advisors (trading robots) remotely, and guarantees full-time operation without having to leave your PC switched on or connected to the internet, as the robot is hosted on the virtual private server that is permanently operational.

This in turn brings the advantage that the speed of execution is much faster than if you had it installed on your computer.

However, to access this service for free you must have a minimum balance of 5000 USD (or equivalent) in your account and also trade at least 5 full lots each month.

If you do not meet these criteria and still wish to access this service, you will have to pay a fee of $28 USD per month, which will be deducted from your balance on the first day of each month.

Is XM an expensive or cheap broker?

The correct way to know if a particular broker is really cheap or expensive is to compare it with other brokers that are already classified as expensive or cheap and that are of course similar in terms of the services they offer.

Therefore, in order to come to a definitive conclusion we have made a comparison table taking into account some key aspects regarding commissions.

| Pepperstone | XM | |

| Average Spread on EUR/USD | 0 | 0.00007 |

| Average Spread on S&P500 | 0.4 | 0.8 |

| Average spread on Gold | 0.19 | 0.35 |

| Average spread on Natural Gas | 1.46 | 0.03 |

| Average commission on Tesla | 0.46 | 9.4 |

| Deposits | 0 | 0 |

| Withdrawals | 0 | 0 |

| Minimum deposit | $200 | $5 |

As you can see, there are some aspects where XM is cheaper than Pepperstone, the cheapest benchmark broker.

You can take a closer look at the commissions of other brokers in these articles: Pepperstone Fees and Commissions, IQ Option Commisions or XTB Commissions

If we analyse point by point we can come to the conclusion that:

- In forex, it offers competitive spreads especially on Zero accounts.

- On indices, the spreads are also in the average of normal, quite similar to the benchmark brokers.

- In energy, it is the cheapest broker of the three, with an average spread for natural gas much lower than Pepperstone.

- In equities, it is by far the most expensive of the three.

- While on deposits and withdrawals we find very similar values.

- With a minimum deposit of only $5 USD, it is the most affordable broker compared to the $200 required to start trading with Pepperstone.

In summary, the XM broker can be considered expensive in some aspects but very cheap in others. Also remember that our comparison only takes into account a group of aspects and assets chosen by us, but they are not entirely definitive.

We therefore encourage you to make your own comparison, and draw your own conclusions. For a more in-depth analysis of XM’s commissions and fees you can open a demo account with this broker.

Throughout this post we have looked at each of XM’s commissions and fees. We hope this analysis has helped you to learn more about XM broker, if so, and you like to help others as much as I do, don’t forget to share this post with your friends.

Thank you very much for your attention.

This post is also available in Spanish: xm comisiones